The money collected from council tax payments helps to pay for local services such as rubbish and recycling collection and local area maintenance. The council tax band is based on property type size location etc.

The Fife Council Glenrothes Home Page

There were 566 such exemptions in NE Fife awarded in 2018 virtually all in St Andrews.

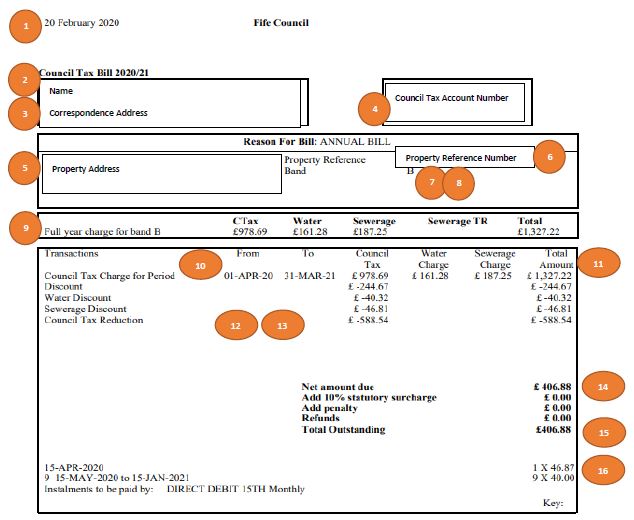

Fife council tax bands. If youre told that you owe arrears of water andor sewerage as part of your council. Rather than price paid. When you receive your council tax bill for the year it will state the additional amount that is being charged for water and sewerage depending on which council tax band your home is in.

The most common recorded business types are Masonic Hall and Shop. This affects every band from A to H. Assuming an average tax band E that works out as a loss to the Council of approximately 400000.

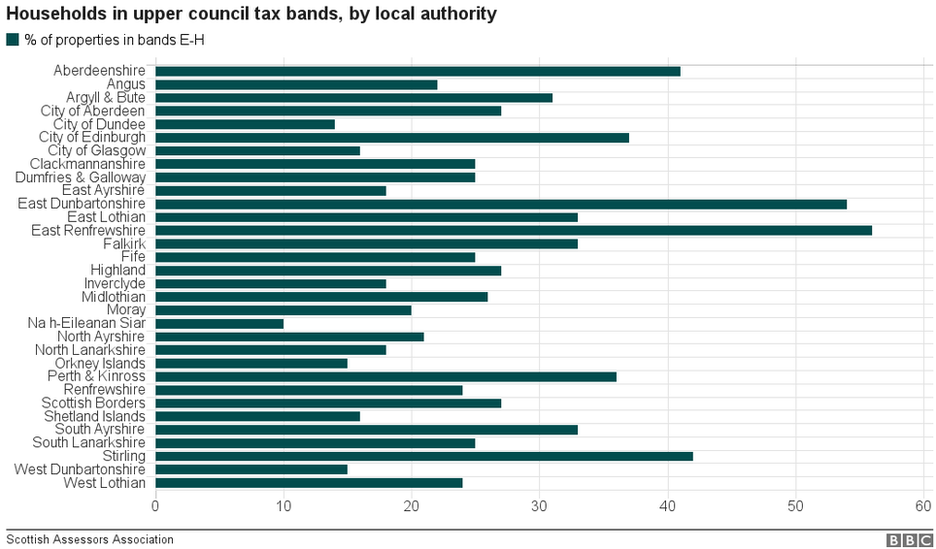

The most common council tax bands are E and D. It was first introduced in January 1980. But the band ranges are different than those in England.

Council tax bands in Scotland. Use our council tax calculator 2021 to see how much your local authority charges for each council tax band. Stormont Road Scone Perth PH2 9PJ.

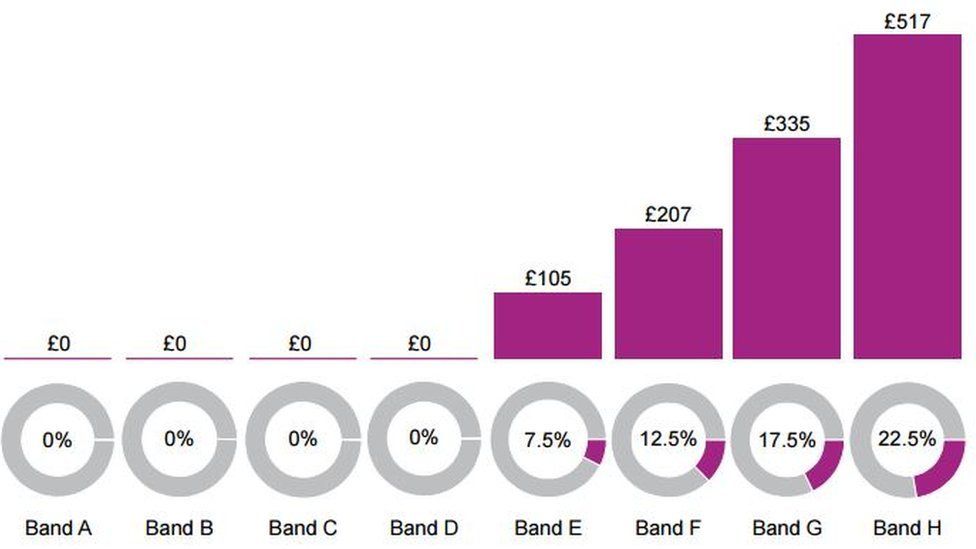

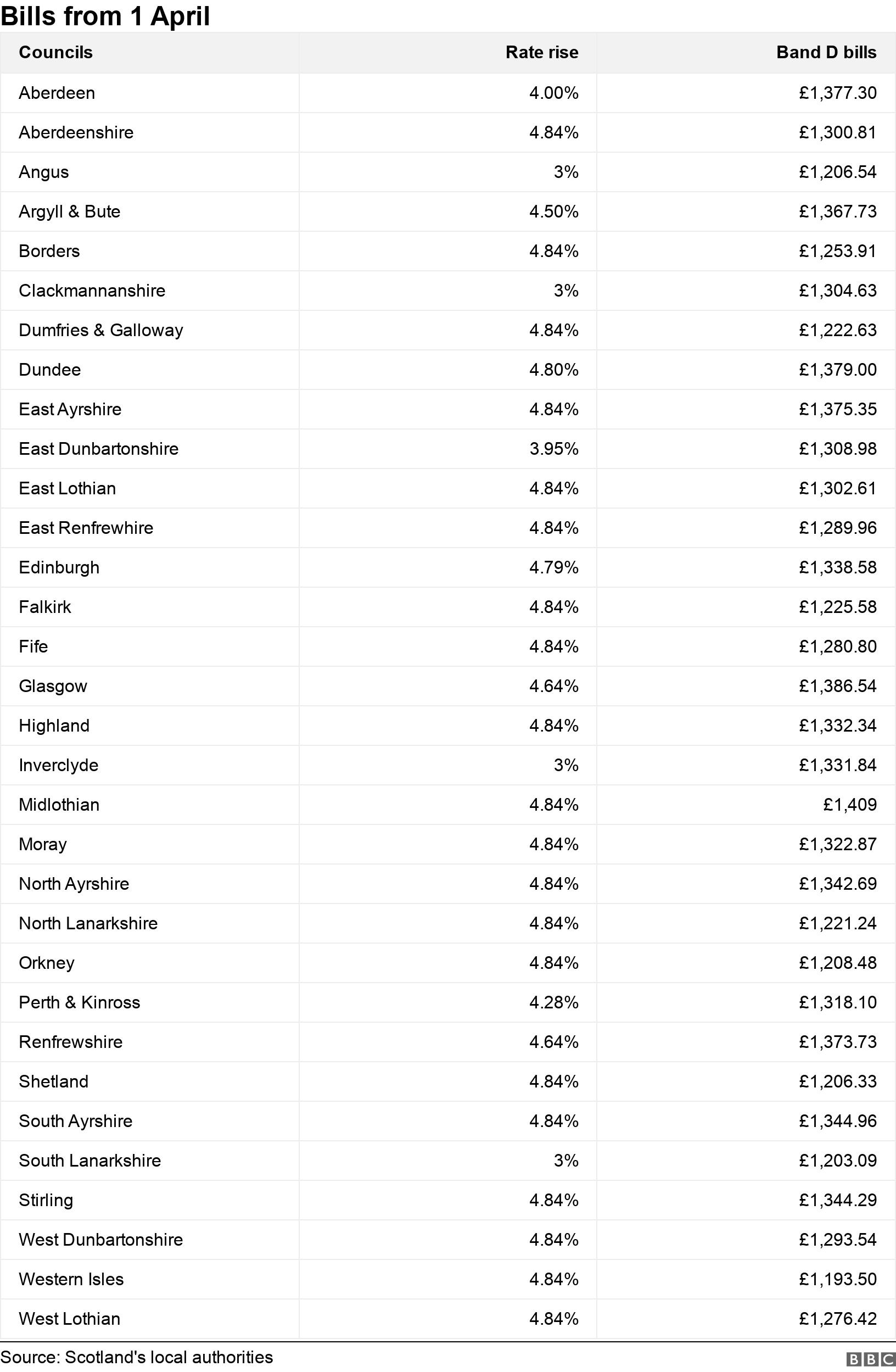

All councils had the power to raise the basic council tax bill by up to 484. Thousands of second home owners in Fife are about to be hit in the pocket after a decision to remove the 10 council tax discount currently afforded to them was rubber-stamped. Increase council tax by 484 on band D from April - 493 a month for a band D household - to raise 79m to put towards local services.

Commercial rateable values range from 14800 to163000 with an average of 66760. 17 April 2020 at 227PM. The default council tax bill assumes two or more adults live in a property.

News Politics Budget D-Day. The full council tax rate is the default setting but many people qualify for a discount. Band D is highlighted as the average council tax bill for householders in.

If the VOA puts you into a higher band you could find yourself paying more council tax as a result. If not then discounts between 25 and 100 are possible this often occurs because certain categories of people are disregarded from council tax. Visit your local council website for information about.

A band review could place your property in a lower or higher band or leave it unchanged. And Use its limited investment ability to provide a 50 sibling discount for music tuition charges and to cover a 75000 shortfall in funding for the Developing the Young Workforce programme. The valuation band ranges for Scotland are as follows.

The most common recorded business type is Shop. New to the market is an unfurnished mid-terraced house in the popular area of Stormont Road Scone. As well as the property address the Valuation Roll also shows the Proprietor Tenant and Occupier of the property and the Net Annual value Rateable Value applied.

The Valuation Roll is a list of all non domestic properties. Registering for council tax. Check your Council Tax band.

650 Month - Mid-Terraced House. It was first introduced in January 1980. Commercial rateable values range from 1650 to 3050 with an average of 2350.

Apply for a Council Tax discount. The most common council tax bands are G and E. Changing your homes valuation could result in a higher council tax bill in some cases.

Find out the Council Tax band for a home in England or Wales by looking up its postcode. This amount is collected by Fife Council and passed on to Scottish Water. The Assessor for Fife is responsible for the compilation and maintenance of the Valuation Roll for the region of Fife.

Start now on the Council Tax valuation list. Fife braced for maximum Council Tax rise Council Tax could rise by 484 per cent today as councillors meet to set the regions budget. Check your Council Tax band.

To view your council tax bands please visit the Scottish Assessors Association website. Properties in Scotland are also put into one of eight bands A-H based on their value in April 1991. The property comprises of entrance hall lounge kitchen.

KY11 3HN is a mixed residential non-residential and agricultural postcode in Limekilns Fife. KY16 9PE is a mixed residential and non-residential postcode in St Andrews Fife. Finding out your council tax band.

Pay Council Tax arrears.

Scottish Local Government Financial Statistics 2016 2017 Gov Scot

Your Bill Explained Fife Council

Scottish Local Government Financial Statistics 2014 15 Gov Scot

Scottish Local Government Finance Statistics Slgfs 2018 19 Gov Scot

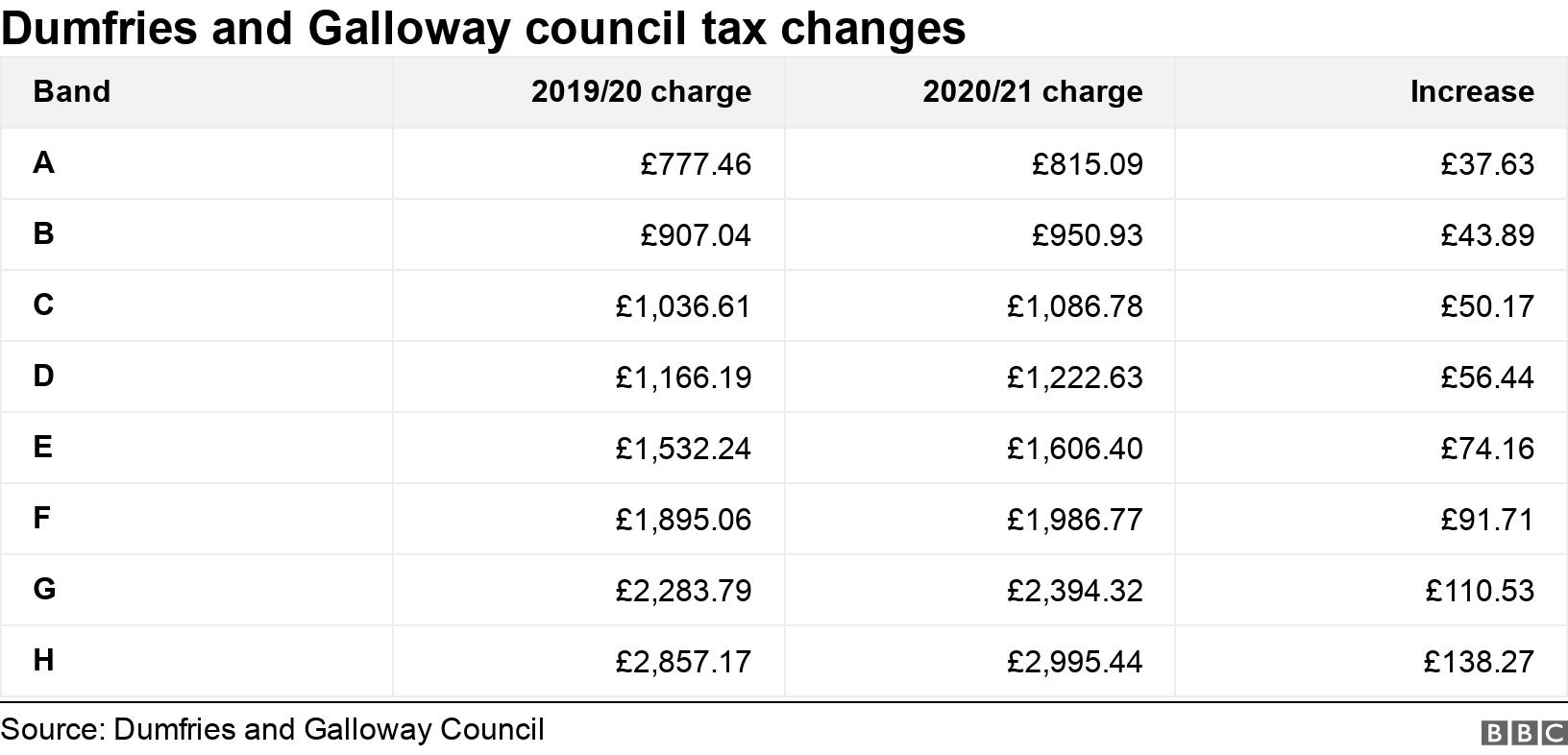

Dumfries And Galloway Council Tax Rise Aims To Avoid Unnecessary Cuts Bbc News

Scottish Council Tax 2020 21 What Will You Be Charged Bbc News

Moray And Shetland Agree 3 Council Tax Rise Bbc News

The Fife Council Policy Finance Asset Home Page

Scottish Council Tax 2020 21 What Will You Be Charged Bbc News

Dumfries And Galloway Council Agrees Tax Freeze Bbc News

Fife Council Due To Freeze Council Tax Rate Dunfermline Press

Scottish Local Government Financial Statistics 2016 2017 Gov Scot

All You Need To Know About Scotland S Council Tax System Bbc News

All You Need To Know About Scotland S Council Tax System Bbc News

Fife Council If You Pay Council Tax But Don T Currently Receive A Council Tax Reduction Then See If You Can Get Help During The Covid 19 Outbreak And If You Have Children

Your Bill Explained Fife Council

Council Tax Reduction In Scotland 2014 15 Gov Scot

Council Tax Reduction In Scotland 2014 15 Gov Scot

No comments:

Post a Comment